Health is the most valuable asset we own, and in today’s uncertain world, medical expenses are rising at an alarming rate. Having the best health insurance plan in India 2025 is not just an option but a necessity. A comprehensive health insurance policy protects you and your loved ones from unexpected medical costs, provides cashless treatment, and even offers tax benefits under Section 80D of the Income Tax Act.

In this detailed guide, we will compare the best health insurance plans in India 2025, analyze features, coverage, premium costs, and benefits to help you make an informed choice and save money.

Why Do You Need Health Insurance in 2025?

Healthcare costs in India are growing at 12–15% annually. A simple hospitalization can cost anywhere between ₹1 lakh to ₹5 lakh in private hospitals. Without health insurance, such expenses can drain your savings. Here’s why choosing the best health insurance plan in India 2025 is crucial:

- ✅ Protection against rising medical bills

- ✅ Coverage for hospitalization, surgeries, and day-care treatments

- ✅ Cashless treatment in network hospitals

- ✅ Preventive health check-ups

- ✅ Tax benefits under Section 80D

- ✅ Peace of mind for you and your family

Top 10 Best Health Insurance Plans in India 2025

Here is a list of some of the most trusted and popular health insurance policies in India this year.

1. HDFC ERGO Optima Restore Health Insurance

- Coverage: ₹3 lakh to ₹50 lakh

- Unique Feature: Automatic restoration of sum insured after every claim

- Best For: Families looking for wide coverage at affordable premiums

2. ICICI Lombard Complete Health Insurance

- Coverage: ₹3 lakh to ₹25 lakh

- Key Benefits: No room rent limit, free health check-ups, wellness rewards

- Best For: Individuals seeking flexibility and extra benefits

3. Star Health Family Health Optima

- Coverage: ₹1 lakh to ₹25 lakh

- Features: Affordable premium, covers maternity, newborn, and organ donor expenses

- Best For: Young families and first-time buyers

4. Niva Bupa (Max Bupa) Health Companion

- Coverage: ₹2 lakh to ₹1 crore

- Benefits: Cashless treatment across 9,000+ hospitals, no age limit for renewal

- Best For: Those seeking lifelong protection

5. Care Health Insurance Plan

- Coverage: ₹5 lakh to ₹1 crore

- Features: Coverage for pre and post-hospitalization, global treatment for critical illness

- Best For: People who want international medical coverage

6. SBI Health Insurance – Arogya Supreme

- Coverage: ₹2 lakh to ₹5 crore

- Features: Covers modern treatments, maternity, AYUSH, and domiciliary hospitalization

- Best For: High coverage seekers and corporate professionals

7. Religare Health Insurance (Care Freedom)

- Coverage: ₹3 lakh to ₹10 lakh

- Special Feature: No pre-policy medical check-up for people with diabetes or hypertension

- Best For: People with existing lifestyle diseases

8. Tata AIG MediCare Health Insurance

- Coverage: ₹2 lakh to ₹20 lakh

- Key Benefits: Covers organ donor expenses, in-patient dental treatment

- Best For: Mid-range budget buyers

9. Aditya Birla Activ Health Enhanced Plan

- Coverage: ₹2 lakh to ₹2 crore

- Features: Chronic management program, wellness rewards, worldwide emergency cover

- Best For: Young professionals and corporate employees

10. ManipalCigna ProHealth Insurance

- Coverage: ₹2.5 lakh to ₹1 crore

- Benefits: Covers alternative treatment, cumulative bonus up to 200%

- Best For: People looking for a balanced plan with wellness benefits

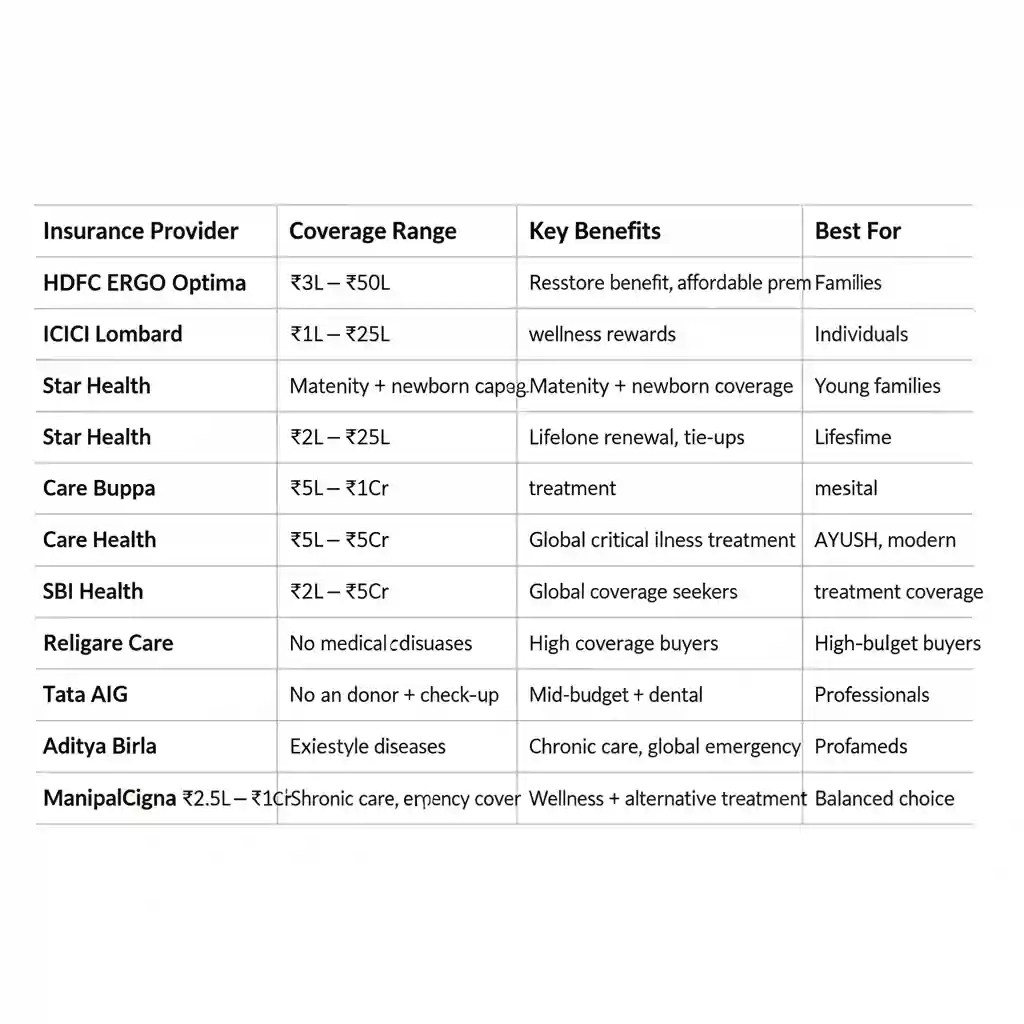

Comparison of Best Health Insurance Plans in India 2025

| Insurance Provider | Coverage Range | Key Benefits | Best For |

|---|---|---|---|

| HDFC ERGO Optima | ₹3L – ₹50L | Restore benefit, affordable premium | Families |

| ICICI Lombard | ₹3L – ₹25L | No room rent cap, wellness rewards | Individuals |

| Star Health | ₹1L – ₹25L | Maternity + newborn coverage | Young families |

| Niva Bupa | ₹2L – ₹1Cr | Lifelong renewal, global hospital tie-ups | Lifelong coverage |

| Care Health | ₹5L – ₹1Cr | Global critical illness treatment | Global coverage seekers |

| SBI Health | ₹2L – ₹5Cr | AYUSH, modern treatment coverage | High coverage buyers |

| Religare Care | ₹3L – ₹10L | No medical check-up for lifestyle diseases | Existing conditions |

| Tata AIG | ₹2L – ₹20L | Organ donor + dental | Mid-budget buyers |

| Aditya Birla | ₹2L – ₹2Cr | Chronic care, global emergency cover | Professionals |

| ManipalCigna | ₹2.5L – ₹1Cr | Wellness + alternative treatment | Balanced choice |

How to Choose the Best Health Insurance Plan in India 2025

- Coverage Amount – Minimum ₹10–20 lakh for families due to rising medical costs.

- Hospital Network – Wider the cashless hospital tie-up, the better.

- Pre-Existing Diseases – Check waiting periods.

- Co-Payment Clause – Lower co-payment = better benefits.

- Maternity & Newborn Coverage – Useful for young couples.

- Renewability – Choose plans with lifelong renewal.

- Premium vs. Benefits – Don’t just look at the cheapest plan; focus on value.

Tax Benefits of Health Insurance in India

Under Section 80D of the Income Tax Act, 1961, you can claim deductions on health insurance premiums:

- Up to ₹25,000 for self and family

- Additional ₹25,000 for parents (₹50,000 if they are senior citizens)

- Preventive health check-up benefit of ₹5,000

Thus, the best health insurance plan in India 2025 not only saves you from medical expenses but also reduces your tax liability.

Common Mistakes to Avoid

❌ Choosing the cheapest plan without analyzing coverage

❌ Ignoring exclusions in the policy document

❌ Not checking the claim settlement ratio of the insurer

❌ Overlooking waiting periods for critical illnesses

❌ Missing renewal deadlines

FAQs – Best Health Insurance Plans in India 2025

Ans: HDFC ERGO Optima Restore and Star Health Family Optima are excellent options for families.

Ans: At least ₹10–20 lakh coverage is recommended due to rising medical costs.

Ans: Yes, under Section 80D, you can claim up to ₹75,000 depending on your family structure.

Ans: Care Health and Niva Bupa provide international treatment coverage.

Ans: Generally, it ranges from 2 to 4 years depending on the insurer.

Conclusion

The best health insurance plans in India 2025 are designed to protect you against financial stress during medical emergencies. From HDFC ERGO to Niva Bupa, each insurer offers unique features catering to different needs.

👉 If you want peace of mind, always compare health insurance policies, check coverage, premium, hospital network, and claim settlement ratio before finalizing. Remember, investing in health insurance is investing in your family’s security.

By choosing wisely, you can save money, get tax benefits, and secure quality healthcare when you need it the most.